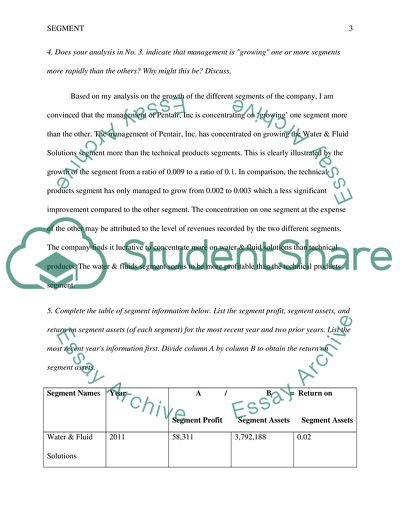

Segmnent (Assignment 11) Assignment Example | Topics and Well Written Essays - 500 words. https://studentshare.org/finance-accounting/1775132-segmnent-assignment-11

Segmnent (Assignment 11) Assignment Example | Topics and Well Written Essays - 500 Words. https://studentshare.org/finance-accounting/1775132-segmnent-assignment-11.