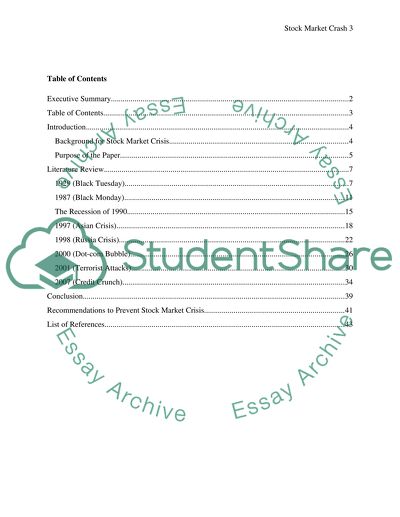

Analyzing the Stock Market Crash Dissertation Example | Topics and Well Written Essays - 10000 words. Retrieved from https://studentshare.org/finance-accounting/1403461-history-of-stock-market-crises-facts-and-figures

Analyzing the Stock Market Crash Dissertation Example | Topics and Well Written Essays - 10000 Words. https://studentshare.org/finance-accounting/1403461-history-of-stock-market-crises-facts-and-figures.