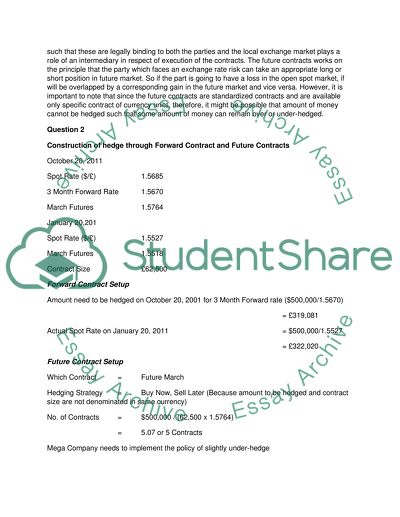

International Finance : Forward Contrats, Currency Futures Coursework. Retrieved from https://studentshare.org/finance-accounting/1452094-international-finance-include-forward-contrats

International Finance : Forward Contrats, Currency Futures Coursework. https://studentshare.org/finance-accounting/1452094-international-finance-include-forward-contrats.