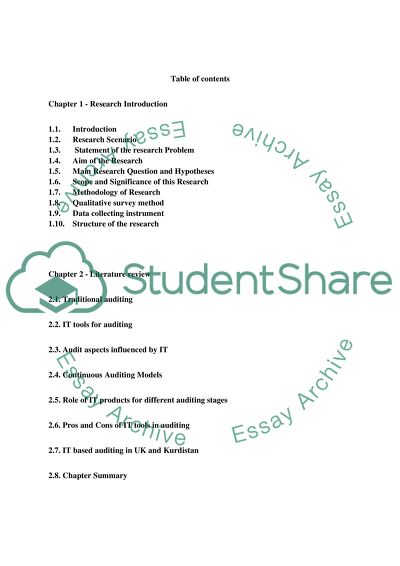

How much IT involved in Auditing to (reduce Duration, Cost and Dissertation. Retrieved from https://studentshare.org/finance-accounting/1467148-how-much-it-involved-in-auditing-to-reduce

How Much IT Involved in Auditing to (reduce Duration, Cost and Dissertation. https://studentshare.org/finance-accounting/1467148-how-much-it-involved-in-auditing-to-reduce.