Cite this document

(“The analysis by Steel Tube division of Engineering Products Plc Assignment”, n.d.)

Retrieved from https://studentshare.org/management/1430668-the-analysis-by-steel-tube-division-of-engineering-products-plc-accountant

Retrieved from https://studentshare.org/management/1430668-the-analysis-by-steel-tube-division-of-engineering-products-plc-accountant

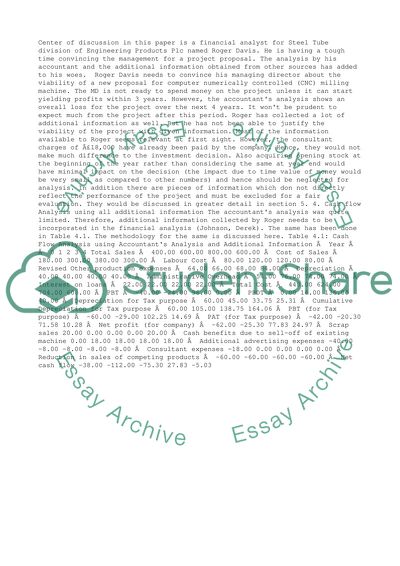

(The Analysis by Steel Tube Division of Engineering Products Plc Assignment)

https://studentshare.org/management/1430668-the-analysis-by-steel-tube-division-of-engineering-products-plc-accountant.

https://studentshare.org/management/1430668-the-analysis-by-steel-tube-division-of-engineering-products-plc-accountant.

“The Analysis by Steel Tube Division of Engineering Products Plc Assignment”, n.d. https://studentshare.org/management/1430668-the-analysis-by-steel-tube-division-of-engineering-products-plc-accountant.