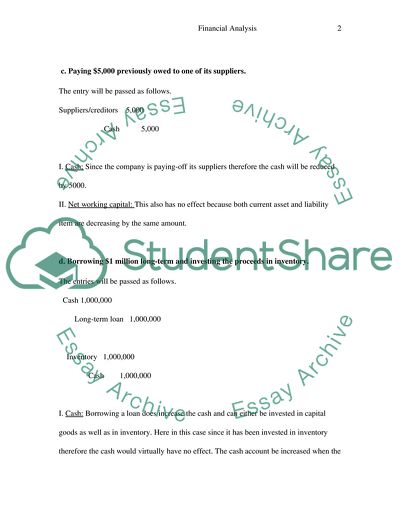

Financial Analysis for Managers: Investing the Proceeds in Inventory Case Study. Retrieved from https://studentshare.org/finance-accounting/1711399-financial-analysis-for-managers-i

Financial Analysis for Managers: Investing the Proceeds in Inventory Case Study. https://studentshare.org/finance-accounting/1711399-financial-analysis-for-managers-i.