Critically analyse how the government debt problems initially faced by Essay - 2. https://studentshare.org/finance-accounting/1812002-critically-analyse-how-the-government-debt-problems-initially-faced-by-a-few-relatively-small-economies-could-trigger-such-a-wide-impact-in-financial-markets

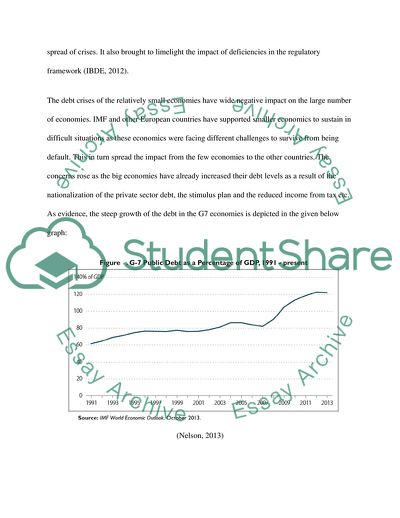

Critically Analyse How the Government Debt Problems Initially Faced by Essay - 2. https://studentshare.org/finance-accounting/1812002-critically-analyse-how-the-government-debt-problems-initially-faced-by-a-few-relatively-small-economies-could-trigger-such-a-wide-impact-in-financial-markets.