- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

- Studentshare

- Subjects

- Miscellaneous

- Text Exercises

Text Exercises - Essay Example

- Subject: Miscellaneous

- Type: Essay

- Level: Ph.D.

- Pages: 4 (1000 words)

- Downloads: 0

- Author: xwitting

Extract of sample "Text Exercises"

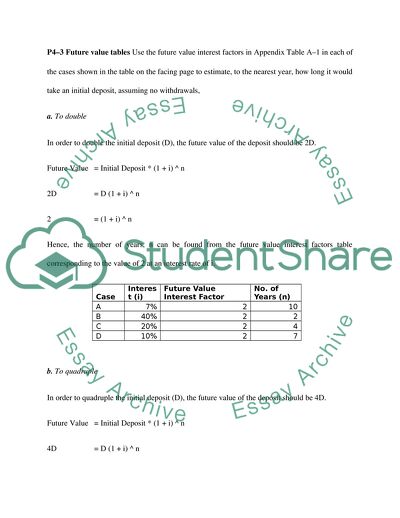

P12–4 Breakeven analysis Barry Carter is considering opening a music store. He wants to estimate the number of CDs he must sell to break even. The CDs will be sold for $13.98 each, variable operating costs are $10.48 per CD, and annual fixed operating costs are $73,500. From the graph, it is evident that for EBIT ranging from $0 - $200,000, the EPS is relatively very high for the Structure A. Once the EBIT crosses $200,000, Structure B has a higher EPS. Hence the following inference can be made.

Leverage is a measure of the debts owed by the company. It indicates the degree of debts in the overall capital structure of the company. It is evident that Structure A has lower debts when compared to that of Structure B. Hence Structure B renders a highly leveraged capital structure to the firm. The higher the debts, the higher the leverage associated with the structure. When the debts are higher, the obligations to prioritize debt payments are also higher for the company. Hence the investors face a higher risk when dealing with a highly leveraged company, as the firm has to pay the debts before providing returns to the investors.

Structure A has lesser risk when compared to that of Structure B. If the firm is certain that it’s EBIT will exceed $75,000, the best recommended structure is Structure B. The main objective of a firm is to maximize the shareholder’s wealth under all conditions. In order to meet this goal, it is essential that the company chooses the capital structure that has the highest earnings per share. When it is certain that the EBIT will exceed $75,000, the structure should be selected in such a way that the EPS is substantial at all levels.

From the graph, it is evident that the EPS is higher for Structure B when the EBIT is above $200,000. Moreover, within the range $75,000 - $200,000, EPS for Structure B is not significantly lesser than Structure A. Hence Structure B will be the best recommended capital

...Download file to see next pages Read More

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY