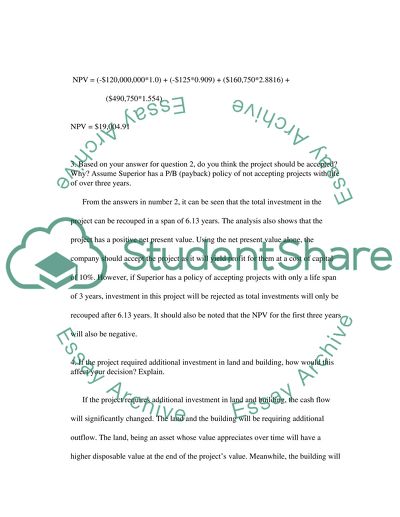

Financial Management Superior Manufacturing Essay. Retrieved from https://studentshare.org/miscellaneous/1512408-financial-management-superior-manufacturing

Financial Management Superior Manufacturing Essay. https://studentshare.org/miscellaneous/1512408-financial-management-superior-manufacturing.