StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Management Accounting - Quarterly Cash Budgets, Trading Profit and Summary of the Trading Operations

Free

Management Accounting - Quarterly Cash Budgets, Trading Profit and Summary of the Trading Operations - Report Example

Summary

The paper “Management Accounting - Quarterly Cash Budgets, Trading Profit and Summary of the Trading Operations” is a meaty example of a finance & accounting report. Here are quarterly cash budgets for the year to31st October 2014. Nov - Jan Feb-Apr May-July Aug-Oct Total…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER97.5% of users find it useful

- Subject: Finance & Accounting

- Type: Report

- Level: Business School

- Pages: 5 (1250 words)

- Downloads: 0

- Author: herzogsister

Extract of sample "Management Accounting - Quarterly Cash Budgets, Trading Profit and Summary of the Trading Operations"

Running Head: MANAGEMENT ACCOUNTING ASSIGNMENT Management Accounting Assignment of the Institute] (A) Quarterly cash budgets for the year to31st October 2014

Nov - Jan

Feb-Apr

May-July

Aug-Oct

Total

Income

Sales

1,563,333

2,000,000

1,416,667

1,120,000

6,100,000

Total Cash Inflow

6,100,000

Expenses

Direct Material Payment

621,000

684,000

477,000

415,800

2,197,800

Direct Labour Payment

528,000

384,000

252,000

302,400

1,466,400

Fixed Production and administration overhead

198,000

144,000

94,500

113,400

549,900

Fixed Selling overhead

160,000

Loan Repayment

100,000

100,000

100,000

100,000

400,000

Interest

9,000

9,000

9,000

9,000

36,000

Total Cash Outflow

4,810,100

Opening Balance

25,000

Net Cash Flow

1,314,900

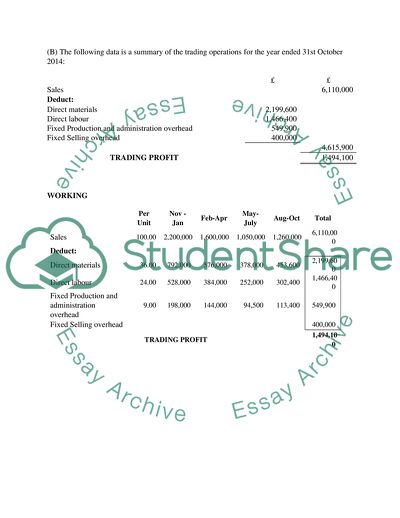

(B) The following data is a summary of the trading operations for the year ended 31st October 2014:

£

£

Sales

6,110,000

Deduct:

Direct materials

2,199,600

Direct labour

1,466,400

Fixed Production and administration overhead

549,900

Fixed Selling overhead

400,000

4,615,900

TRADING PROFIT

1,494,100

WORKING

Per Unit

Nov - Jan

Feb-Apr

May-July

Aug-Oct

Total

Sales

100.00

2,200,000

1,600,000

1,050,000

1,260,000

6,110,000

Deduct:

Direct materials

36.00

792,000

576,000

378,000

453,600

2,199,600

Direct labour

24.00

528,000

384,000

252,000

302,400

1,466,400

Fixed Production and administration overhead

9.00

198,000

144,000

94,500

113,400

549,900

Fixed Selling overhead

400,000

TRADING PROFIT

1,494,100

Usually the cash flows statements are require by the accounting personnel’s, investors, employees and so on. Basically it consists of three major activities:

Operating activities

Investing activities

Financial activities.

Operating activities:

The cash flow statement in accounting consists of the operating activities, that are the activities belong to the sales purchase shipping of products, products advertising. The items of operating activities include:

Net income

Depreciation

Non cash items

Deferred tax

Accrued items

Amortization of interest.

Investing activities:

For the purchase of long term assets and the sale of long-term assets your company needs the investing activities, so all of the investing activities which the company has incurred in a specific period are included in the cash flow statement. It involves the current expenditures and investments which the company made in a specific period.

Financial activities:

Now coming towards the third part of the cash flow statement, which is the financial activity. It involves the outgoing cash flows and also the cash from banks and share holders, usually the dividend payments, sale and purchase of stocks and the borrowings from different financial institutions are recorded in the financial activities of cash flow. There are two methods for writing the cash flow statement this we called the cash flow statement directly or the cash flow statement indirectly. The direct method of cash flow statement don’t involves so many transactions it just started from the sales and ends by mentioning the income statement and the current assets and liabilities while the indirect methods of making the cash flow statement involves to start from the net profit or loss and then the adjustment of all non cash items.

(C) The following data is a summary of the trading operations for the year ended 31st October 2014:

£

£

Non-current assets at NBV

2,400,000

Current Assets:

Closing inventory of finished goods

1,778,700

Trade receivables (debtors)

2,310,000

Cash and bank

1,314,900

5,403,600

Current liabilities:

Trade payables (creditors)

226,800

Net current assets

5,176,800

Non-current liabilities:

Long-term loan

1,500,000

Net Assets

6,076,800

Represented by:

Equity

Ordinary share capital

1,000,000

Retained Profit

5,076,800

Total Equity

6,076,800

Because the overall cost of funds in the typical community bank (including both interest and operating costs) often comprises over 80% of the institutions expense, managing this expense is very likely the single most important issue in accounting. This is especially true at the departmental level. With no generally accepted, single, "off-the-shelf" formula in use, companies attempt to set their transfer funds costs using a variety of methods. As a result, peer-performance comparisons are difficult, if not impossible. Often, the method that is finally selected is heavily influenced by its own philosophy of funds management, due to the absence of any industry-accepted standard. Even allowing for philosophical differences, however, I believe we need to consider the impact that their choice of method can have on planning efforts. The first step to determine funding cost is to compute its actual internal costs to generate funds. Often the data to generate this information are readily available in general ledger records, though digging is sometimes required. This produces your true "inventory" costs on an ongoing basis. This is commonly referred to as pool cost of funds. In the process of computing the cost, the total funds lose their individual identity, as all funds and their related costs enter the general pool of available funds. The total costs associated with the pool, are totaled, creating the overall costs of obtaining, maintaining, and servicing the pool of available funds.

The second approach essentially "transfers" income from one side of the balance sheet to the other. As it rewards the fund suppliers at a markup over their actual cost to generate funds, this approach penalizes the fund users (earning asset departments) by charging for funds at this market cost. The difference between cost and market is often referred to as the "competitive advantage" (i.e., at how much less cost the branch network can generate funds when compared with the open market cost to purchase similar funds). Why use this method? Backers point out that using market pricing challenges earning asset departments to price their products at a level sufficient to absorb the "market" funds costs, plus departmental overhead. While various market sources can be applied, the most popular is probably the Treasury yield curve. Using an external market figure in place of your own costs to evaluate your inventory appears quite contrary to basic accounting standards.

Equipped with the proper tools, a good accounting system and a solid understanding of your competitive market areas, the funds transfer credit choice becomes easier. Trying different approaches and viewing their results remains a very helpful exercise. However, bear in mind that when you decide on the correct approach, stick with it. As with any other major area in accounting, consistency is paramount.

REFERENCES

The Washington Post, p. A3, October 15, 1996.

Institutional Investor, p. 61, December 1996.

Newsweek, p. 54, September 9, 1996.

Inc. Magazine, p. 32, December 1996.

News Release, California Public Utilities Commission, CPUC-5, February 5, 1997

Principles of Accounting, Meigs and Meigs, 11th Edition.

Read

More

CHECK THESE SAMPLES OF Management Accounting - Quarterly Cash Budgets, Trading Profit and Summary of the Trading Operations

Non-Governmental and For-Profit Organizations

Financial management practices in NGOs are different from the operations of For-Profit organizations.... In some instances, some NGOs have adopted the structure of a private company and used this structure to manage their financial operations.... This essay "Non-Governmental and For-profit Organizations" discusses financial management which is at the core of implementing organizational objectives and goals.... This is different from For-profit organizations that source their funds from shareholders who are the real owners of organizations....

6 Pages

(1500 words)

Essay

Finance and Public Administrators

Chan (2009) indicates that this type of accounting is described as management accounting in business and budgetary accounting in the public sector.... In addition to those capital requirements, the expenses relating to the day-to-day operations of the city need to be taken into account.... Table 2 shows a summary version of the city's budget for the fiscal year ending 31st March 2012.... Non-profit organizations play a useful role in the city and so a certain level of funding is normally made available to them so that they can continue to achieve their goals....

9 Pages

(2250 words)

Research Paper

Company Budgeting System

The purpose of budgeting system is to efficiently manage performance of an organization.... It summarizes the phases of saving and income over a period of time that helps the organization to check its.... ... ... The research work begins with a brief description of background of the company that has been selected for analyzing, that is, PepsiCo....

14 Pages

(3500 words)

Essay

The Olive Tree Restaurant Analysis

The Olive Tree Restaurant boasts several strengths although, like any other business, there are various weaknesses associated with its operations.... ffective restaurant operations: This strength is generated by the high morale among the restaurant's staff.... The major strength is its ability to record large sales amounting to almost £600,000 (588,498 to be exact) within the first trading period.... This has helped in widening the business profit margins (Chandler, 1962)....

9 Pages

(2250 words)

Essay

Financial Funding for Glen Company Inc

he structure of this paper;The research tries to capture vital things inculcated in business financing such as;A summary of the whole process of financial funding for Glen Company inc.... Why then do this company need additional financing;Improvement of operations: The venture lab is an "experimental project" and so is seeking the "Next big thing".... I believe that most companies that seek to improve on their operations would seek more funding in order to improve on their service delivery, cut on operation costs, and improve their productivity....

9 Pages

(2250 words)

Thesis Proposal

Accounting Representation of Private and Public Sector

Billion pounds, 1568 Million pounds EBITDA, and 1300 Million pounds as the trading profit.... Last year, the company recorded 23 Billion pounds as revenue, 1443 Million pounds as EBITDA, and 1195 Million pounds as trading profits.... The government is planning to cash in more than 500 million pounds when the Cancer Drug Fund program is implemented.... The paper 'accounting Representation of Private and Public Sector' is an entertaining example of a finance & accounting report....

11 Pages

(2750 words)

Managing Financial Principles and Techniques

The paper "Managing Financial Principles and Techniques" is a wonderful example of an assignment on finance and accounting.... The paper "Managing Financial Principles and Techniques" is a wonderful example of an assignment on finance and accounting.... Task 4 will evaluate the activity-based costing systems used by Best Way manufacturers and will recommend two alternative cost reduction and management processes that could lead to further reduction....

23 Pages

(5750 words)

Assignment

Wonder Bottle Manufacturing Company's Strategy

The observed experience of the trading company headed by the Managing Director has empowered the organization to focus on development and to trade in the outside business sector.... (Reilly 41)The administration group in charge of the Product and Services specialization and active administration of the everyday operations includes various top departments such as a finance department, sales department, and production department....

18 Pages

(4500 words)

Business Plan

sponsored ads

Save Your Time for More Important Things

Let us write or edit the report on your topic

"Management Accounting - Quarterly Cash Budgets, Trading Profit and Summary of the Trading Operations"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY