StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Investor Psychology and Behavioral Finance

Free

Investor Psychology and Behavioral Finance - Lab Report Example

Summary

In the paper “Investor Psychology and Behavioral Finance”, one will focus on the relationship between the coverage number and the buy-side job by developing two hypothesis tests. The first hypothesis test determines the impacts of the number of coverage to the analysts…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER94% of users find it useful

- Subject: Finance & Accounting

- Type: Lab Report

- Level: Ph.D.

- Pages: 4 (1000 words)

- Downloads: 0

- Author: leonieritchie

Extract of sample "Investor Psychology and Behavioral Finance"

of Investor Psychology and Behavioral Finance Introduction Different s have different positions in the market. In preparation for financial analysis, they employ strategies that can best fit their business model. In general, there are two kinds of analysts; buy-side and sell-side. Buy-side analysts, also known as buyers, identify valuable opportunities for their company. Buy-side analysts help to improve the portfolio performance using strategies such as “buy low sell high”. In most cases, Buy-side analysts work for firms like hedge funds, pension funds, and mutual funds (Wall Street Wannabe, 2014). On the other hand, sell-side analysts, also known as sellers, mainly evaluate future earnings growth of a company. Also, they focus on equity research so as to provide a recommendation for investment decision (Buyside Media, 2014). Most of the time, they work for brokage firms.

Since buyers have to make an investment decision, they need certain experience before becoming buy-side traders. Thus, most analysts start as sell-side traders for several years in order to gain experience and switch to the buy-side. According to Yang, buy-side performance is relatively the same as compared to the sell-side performance. In this case, the performance is relatively the same in terms of number of coverage. In this report, coverage is defined as the number of stocks that sell-side analysts covered before they leave their sell-side job.

Summary

In the report, one will focus on the relationship between the coverage number and the buy-side job by developing two hypothesis tests. The first hypothesis test determines the impacts of the number of coverage to the analysts. The test will determine on which side the analysts will go to after resigning their first sell-side job. For instance, the analysts can either choose buy-side or sell-side. The results indicate 95% confidence that the number of coverage is equal. As a result, coverage does not affect the analysts’ choice of a job after their first sell-side job. The second hypothesis test determines whether if analysts resign their sell-side job for the buy-side job after attaining coverage of 15. In turn, the results demonstrate 95% certainty that analysts do not have to achieve coverage of 15 for them to quit their jobs.

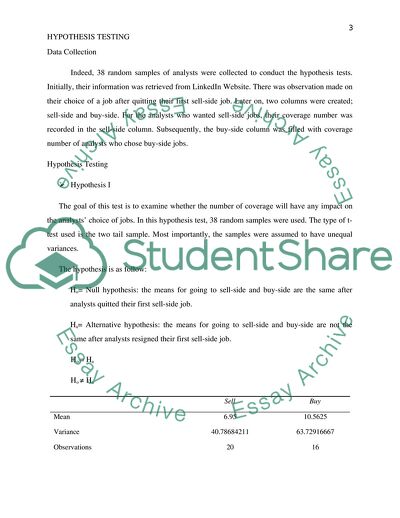

Data Collection

Indeed, 38 random samples of analysts were collected to conduct the hypothesis tests. Initially, their information was retrieved from LinkedIn Website. There was observation made on their choice of a job after quitting their first sell-side job. Later on, two columns were created; sell-side and buy-side. For the analysts who wanted sell-side jobs, their coverage number was recorded in the sell-side column. Subsequently, the buy-side column was filled with coverage number of analysts who chose buy-side jobs.

Hypothesis Testing

Hypothesis I

The goal of this test is to examine whether the number of coverage will have any impact on the analysts’ choice of jobs. In this hypothesis test, 38 random samples were used. The type of t-test used is the two tail sample. Most importantly, the samples were assumed to have unequal variances.

The hypothesis is as follow:

Ho= Null hypothesis: the means for going to sell-side and buy-side are the same after analysts quitted their first sell-side job.

Ha= Alternative hypothesis: the means for going to sell-side and buy-side are not the same after analysts resigned their first sell-side job.

Ho = Ha

Ho ≠ Ha

Sell

Buy

Mean

6.95

10.5625

Variance

40.78684211

63.72916667

Observations

20

16

Hypothesized Mean Difference

0

Df

28

t-Stat

-1.472049843

P(T

Read

More

CHECK THESE SAMPLES OF Investor Psychology and Behavioral Finance

Behavioural Finance

This research will begin with the statement that behavioral finance is the humanistic approach to financial decision making, where quite often the generally accepted rules of accounting, cash management, p/e ratios and other criteria used to make wise decisions often do not apply.... This is a broad introduction, but to understand behavioral finance one has to understand human psychological responses and emotions that are involved in decisions.... The researcher states that behavioral finance examines how the human animal reacts in a financial system theoretically devoid of any emotions....

7 Pages

(1750 words)

Essay

Behavioural Finance Implications on Personal Investment Decisions

This essay "Behavioural Finance Implications on Personal Investment Decisions" discusses the manager's cognitive psychology and arbitrates the investigation of the variables.... n the current circumstances, behavioural finance is increasingly attaining an integral position in the decision-making procedure, since it increasingly affects the performance of investors (SHEFRIN, 2007: p77).... Comprehending behavioural finance will play a vital role in enabling the investors to adopt a better investment mechanism and evade future repetition of costly errors....

6 Pages

(1500 words)

Essay

Behavioural Finance

behavioral finance insists that investors are irrational in their decisions and that it is easy to partly predict future performance of stocks using their past performance.... Topic: Behavioural finance Name Professor Institution Course Date Many studies in the area of behavioural finance suggest that individual investors make systematic errors due to behavioural biases.... Given such conditions, a rational investor has high chances of recording collectively efficient outcomes from investment decisions....

3 Pages

(750 words)

Essay

Behavioral Finance Heuristic and Judgment, a literature review

Nevertheless, despite the voluminous literature on the topic, both efficient markets and behavioral finance proponents agree that their models have not managed to fully explain capital markets behavior.... n the other side are the behavioral finance academics who claim that capital markets are inefficient, citing observable market anomalies showing that stock price behavior is predictable, that investors are irrational, and that many can earn above average returns or beat the market (Shiller 1981/1990/2000)....

5 Pages

(1250 words)

Essay

Investor Psychology and Return Predictability

This proposition for investor's psychology affect the return predictability can be shown to be precisely true in several popular mathematical models of the portfolio decision.... One may expect that an investor facing the small but non-zero probability of an extreme realization will not allocate his wealth in the same manner as an investor who only cares about the first and second moment.

... n this contribution, we investigate how an investor will change his portfolio allocation when he cares not only about mean and variance but also about the third and fourth moment....

11 Pages

(2750 words)

Essay

Investor Sentiment and the Implications of Their Behaviour

The behavioral finance as a field, therefore, focuses upon understanding as to how such cognitive behaviors can be explained besides exploring as to why such errors occur in investor judgments.... behavioral finance, therefore, uses the theories from psychology as well as sociology and other disciplines to actually explore and understand basic investor behavior and how it may have an impact on the market.... Earlier theories of finance-focused upon the key assumption of investors acting rationally and markets also responding to the same....

6 Pages

(1500 words)

Research Paper

Behavioural Finance

This is, of course, a very broad introduction to a much more complex subject, but in order to understand behavioral finance, one has to understand human psychological responses and emotions that are involved in these decisions.... herefore, stated a bit more succinctly, behavioral finance examines how the human-animal reacts in a financial system theoretically devoid of any emotions.... 'Proponents of behavioral finance contend that people may not always be 'rational,' but they are always 'human....

6 Pages

(1500 words)

Term Paper

Efficient Market Hypothesis

The efficient market hypothesis and behavioral finance are two economic models that almost contradict each other.... The efficient market hypothesis and behavioral finance are two economic models that almost contradict each other.... The efficient market hypothesis and behavioral finance are two economic models that almost contradict each other.... The paper "Efficient Market Hypothesis" is a great example of a finance & Accounting research paper....

17 Pages

(4250 words)

Research Paper

sponsored ads

Save Your Time for More Important Things

Let us write or edit the lab report on your topic

"Investor Psychology and Behavioral Finance"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY