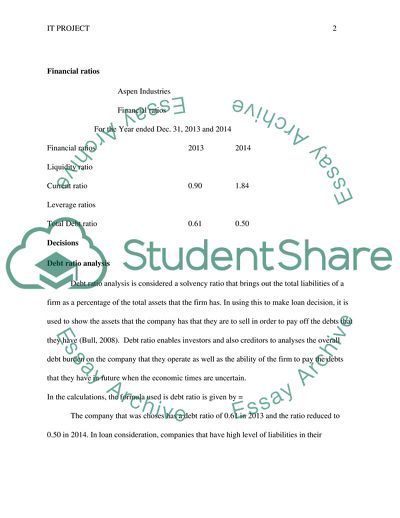

Aspen Industries' Financial Ratios - Liquidity Ratio, Current Ratio, L Research Paper. https://studentshare.org/finance-accounting/1876354-it-project

Aspen Industries' Financial Ratios - Liquidity Ratio, Current Ratio, L Research Paper. https://studentshare.org/finance-accounting/1876354-it-project.