Ploting the current yield curve Research Paper Example | Topics and Well Written Essays - 1000 words. Retrieved from https://studentshare.org/finance-accounting/1483207-ploting-the-current-yield-curve

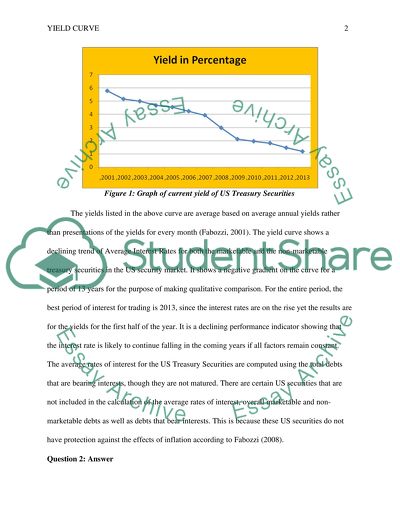

Ploting the Current Yield Curve Research Paper Example | Topics and Well Written Essays - 1000 Words. https://studentshare.org/finance-accounting/1483207-ploting-the-current-yield-curve.